When public sector procurement is mentioned, it is often to discuss the complexities of compliance with strict processes and procedures and the challenges which may arise holistically when these are not followed as fastidiously as they might have been.

When public sector procurement is mentioned, it is often to discuss the complexities of compliance with strict processes and procedures and the challenges which may arise holistically when these are not followed as fastidiously as they might have been.

Thoughts on public sector procurement

However, what often falls below the radar is how suppliers feel about the way public sector procurement has treated them. In our own experience in dealing with over 500 complex and strategic supplier relationships, there are some specific complaints and concerns suppliers have about what they have experienced during procurement processes – and these are often not limited to the public sector.

They usually include such issues as poor articulation of outcomes, expectations and requirements (we personally find this is the main concern), poor procurement and uninformed negotiation practices, procedural errors, late (very) payments, and miscommunication. A deeper understanding of any one of these and the processes to mitigate them will pave the way to productive change in both the public AND private sectors.

As advocates of the ‘learning from the lived experience’ approach to all aspects of complex supplier relationships, we know how important it would be for public sector bodies in particular to gain a holistic picture of how aspects of the procurement process can be improved upon.

It’s also important to identify what might be disincentivising suppliers to respond to your tenders most of all, so that appropriate consideration can be afforded to ways in which real change can occur and much better and wider engagement can be achieved.

To help support some of this process, there is a team within the Cabinet Office – the Public Procurement Review Service (PPRS).

They are there to collect and collate the complaints that suppliers wish to make, anonymously, about their experiences of public sector procurement. The results of the statistics when reviewed, show an interesting pattern.

The PPRS progress report

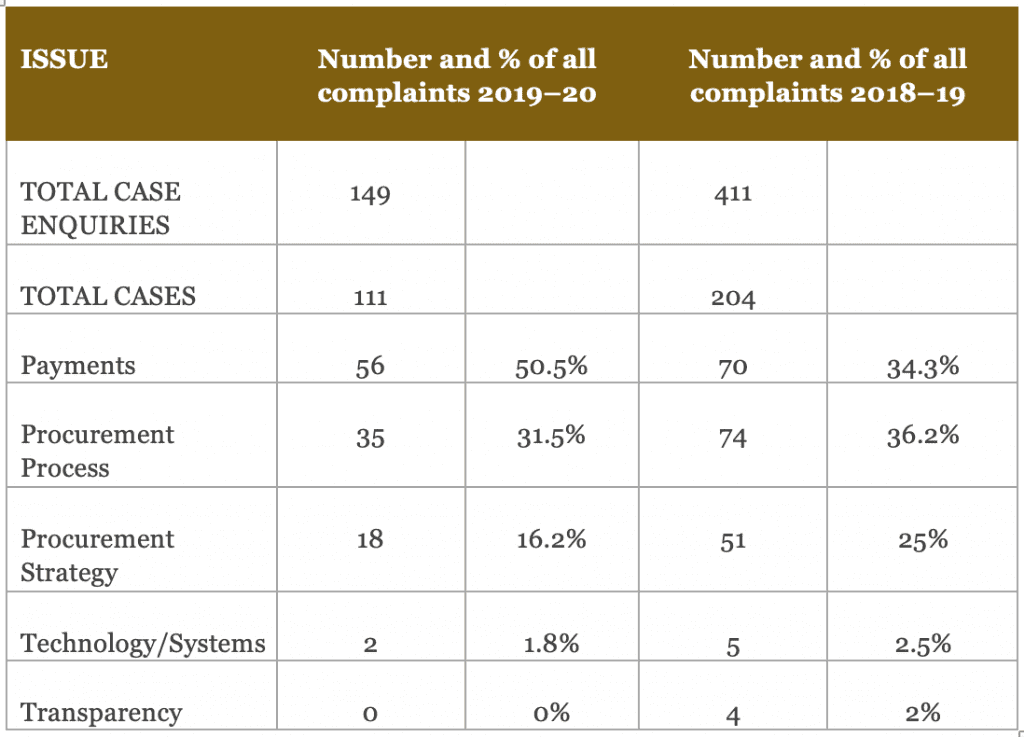

Once a year, the PPRS produces a Progress Report so you can compare how the supplier market views public sector procurement through the lens of the number of complaints in specific areas. The latest report was produced for 2019–20 and it highlights areas of concern categorised under five headings: payment, procurement process, strategy, technology/systems and transparency.

The table below shows the number of enquiries to the PPRS, how many of these progressed to cases, and what the fundamental issues were that drove the complaints. From the tabled statistics, we can not only look at the number of complaints dedicated to each area to see which were the most common, but also how they have changed since the last recording of them the year before.

Source: Public Procurement Review Service Progress Report 2019/20

Source: Public Procurement Review Service Progress Report 2019/20

As we can see from the table, the leading areas of complaint were ‘Payments’ and ‘Procurement Process’, which covered 82% of all complaints to the PPRS in 2019–20.

Four out of the five PPRS classified issue categories, had seen falls in both numbers and percentage of total, with only ‘Payments’ being lower in number of complaints, but significantly higher (34% to 50.5%) as a proportion of total complaints from the year before.

Most dramatic of all is the difference in enquiries and cases, with enquiries falling 63.7% and cases falling by 45.6% between the 2018–19 and the 2019–20 reports.

Public Sector Procurement – Top five areas of complaint

The top five areas of complaint regarding public sector procurement from across all PPRS categories were:

- non-payment of invoices

- bias advertisements presumed to favour a particular supplier

- unfair advantage of incumbent supplier or a lack of communication about the award of the contract

- how the evaluation process was run

- delayed or lack of response to clarification questions

Being mindful that behind every complaint may be a disgruntled supplier whose relationship has been compromised and the ramifications of which could expand beyond their current partnership or prospect into their other collaborations, it’s important to consider how the risk of this can be reduced.

8 steps to more harmonious supplier relationships

Having worked on hundreds of complex strategic relationships over the last couple of decades, we have recognised that, at a fundamental level, there are eight key components to improving tender response rates from your suppliers and generating much greater lifetime value with those you eventually contract with.

-

- Communication

One of the primary triggers for deviation from relational norms is poor communication leading to a misunderstanding. It is, therefore, vital that you build into your processes a set of promises and checks so everything which is important for you to communicate in order for your suppliers to understand with crystal clarity, is well-defined and quantified, and can be understood with enough depth and nuance by all parties.

This goes for your own internal communications as well, because your team must fully appreciate their role and place in the wider process of the project and relationship. In other words, does everyone understand what needs to be done, by whom, why it’s being done, what business outcomes and objectives you are aiming to achieve, and the milestones that need to be passed along the way (KPIs)? Check and double check to make sure they do.

-

- Intelligence

Client-side oversight on a project requires intelligence in terms of both knowledge of what is going on within the project and taking a smarter approach to collaboration within the relationship to allow for better monitoring and closer management. The days of passing full responsibility to a supplier without being fully informed about who is best to take on some of the risks, have been confined to the ‘inadvisable strategy’ wastepaper basket of the past. You should take into account the supplier’s ‘expert responsibilities’ to inform yourselves about where the lines would be most appropriate to be drawn. In this way, you reduce risk pricing for those areas where the supplier would not be advised to shoulder certain risks due to its lack of specific expertise.

It’s also important to build collaborative working relationships that encourage deeper, more regular, project assessment against KPIs so issues can be identified and addressed before they become too significant to handle. If done well, client-side oversight should be more like guiding than instructing your supplier because you are giving yourself more time to turn the metaphorical relation-ship from iceberg danger.

-

- Innovation

Your supplier’s motivations and commitment to the outcome goals that you are striving towards will determine their propensity towards innovation. And, as innovation is one of the driving forces behind successful outcomes in most strategic relationships, it’s a behaviour that should be sought out and encouraged in your suppliers.

Collaborative working relationships encourage the drive to innovate in partnerships because your supplier is fully committed to the relationship, their goals are aligned to your goals, and they recognise that they can use their expertise to surpass your outcome expectations or achieve them more efficiently.

-

- Outcomes

Coming back to the issue of clarity in your communications, it’s vitally important for you to define the end point (or the point at which your vision has been realised) in your project, the outcomes you are looking to achieve with your supplier’s assistance.

This needs to be quantified in detail, the transformation from your ‘before’ state to your ‘after’ state needs to be clearly defined. The issues that will exist should your vision not be realised must be made clear to your supplier and quantified in both operational and financial terms and identify the relative importance of the project. And the reliance of responsibility you are placing on their expert knowledge must be stressed.

-

- Responsibilities

Expert suppliers have ‘expert responsibilities’ which includes a ‘duty to warn’. In short this means that as an expert your supplier takes responsibility for identifying and expressing any issues which could stand in the way of them achieving the outcomes you have clearly explained to them.

This includes a duty to warn if you have not been clear enough in your explanation of the outcomes destination, if they are lacking in any resource which could impact on their ability to fully achieve the expressed outcomes, and so on. This should not be considered a blunt tool to use against your supplier should anything go wrong; this is a responsibility which can be used to everyone’s advantage to ensure that all materially perceived weaknesses in the relationship and/or expertise can be aired and discussed from the outset.

-

- Due Diligence

For a supplier to fully appreciate the task that they are being asked to complete and the relative issues and weaknesses which could impact on their ability to deliver, it’s important that they run a complete due diligence exercise. This will go below the surface of the project, revealing deeper challenges so a spotlight can be shone on them and so your supplier can report back, in a complete fashion, on their true ability to achieve the outcomes expected within the relationship.

-

- Governance

Skilfully managed relationships foster greater trust and opportunities for success. Challenges are then faced as partners rather than as competing adversaries, and clarity of communication is prized and expected. Buying governance is the strategic oversight that looks to guide, assess and realign when necessary, every aspect of your relationship from start to successful conclusion.

While each of the six points above deal with specific areas which drive better collaboration and stronger relationships, buying governance is the glue that keeps them all together.

-

- Contract

An effective contract is one that has been formed to not only protect the parties, but to drive the right kind of behaviours, ones that encourage honesty and innovation. A ‘fit for purpose’ contract is one that draws parties closer together into a partnership relationship and one that requires regular assessments of not only progress within the relationship, but also the suitability of the contract’s methods and expectations against the real-world backdrop of the project.

Your contract should include not only expression of all seven of the points made above, but also guidance on how they should be used and implemented to drive more collaborative and trust building actions which create more alignment between the parties.

Conclusion

Public sector procurement is complex and long-winded, and there are many challenges along the way. However, because there is a clear process to follow this should make it easier to identify when it is not being achieved. The PPRS report provides a vital window on this world and one that all who work within public sector procurement should be looking through on a regular basis to appreciate where there is potential for the wheels to come off within their supplier relationships.

Greater knowledge of this can lead to better planning for such an eventuality, better evaluation of your supplier relationships and recognition of the importance of true collaboration within them can prevent the problems which lead to the common complaints reported to the PPRS from happening in the first place.

Source:

Source: